Understanding how economies function is essential in a world of growing debt, fluctuating interest rates, and geopolitical uncertainty. Ray Dalio’s “How The Economic Machine Works” simplifies the complex world of economics into a clear, visual framework that is more relevant in 2025 than ever. With global debt expected to hit new records and inflation shaping fiscal policy, Dalio’s timeless blueprint helps citizens, investors, and policymakers grasp the inner workings of macroeconomic dynamics.

Let’s unpack the video’s most important lessons with fresh analysis, using insights from 2024–2025 sources including the IMF, OECD, NBER, and major news outlets.

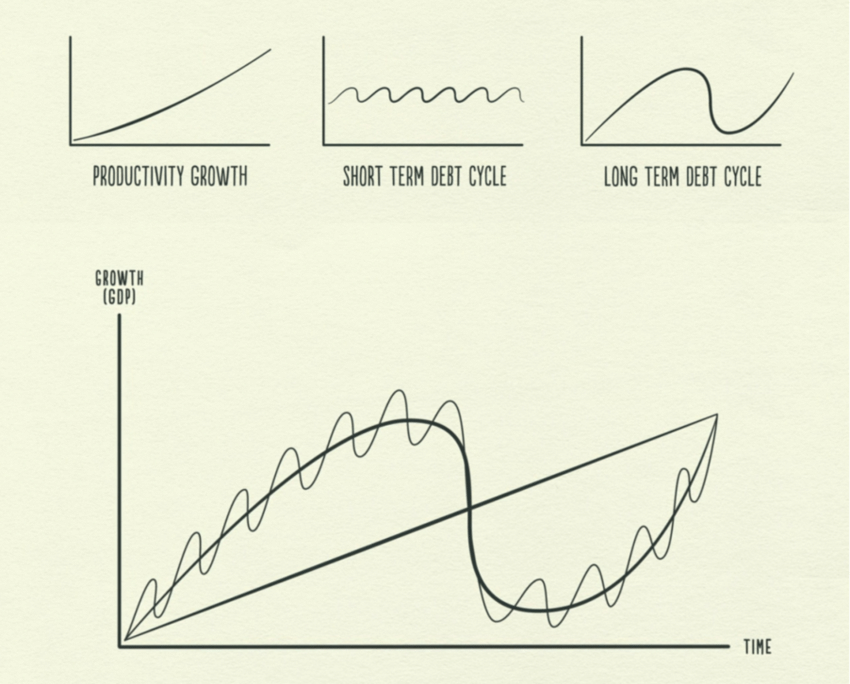

The Three Forces That Drive the Economic Machine

1. Productivity Growth: The Engine of Long-Term Wealth

At the core of any economy is productivity — how efficiently we produce goods and services. Productivity grows through innovation, education, and infrastructure investment. Over time, this is what creates real wealth.

“In the long run, productivity matters most. But in the short run, credit matters more.” — Ray Dalio

Dalio explains that while productivity steadily increases, it does not cause economic cycles on its own. Instead, it provides the foundation on which the other two forces — short- and long-term debt cycles — operate.

2025 Insight:

The OECD Global Debt Outlook 2025 confirms that economies with high productivity growth are better equipped to withstand debt shocks. However, excessive leverage has slowed productivity in some G7 nations by as much as 1.2% annually.

2. The Short-Term Debt Cycle (5–8 Years): Credit Drives Spending

Credit is what allows people and businesses to spend more than they earn. When credit grows, spending increases, which boosts incomes and asset prices. This cycle repeats every 5 to 8 years:

- Borrowing increases → economic expansion

- Spending outpaces production → inflation

- Central banks raise interest rates → borrowing slows

- Recession sets in → deleveraging occurs

- Central banks lower rates again → cycle restarts

Dalio refers to this as a self-reinforcing loop. When people feel richer (from rising incomes and asset values), they borrow more. But eventually, debts must be paid — and this causes contraction.

2025 Insight:

The NBER’s April 2024 working paper revealed that short-term cycles have become more volatile due to faster credit expansion enabled by fintech and decentralized finance (DeFi). As credit creation becomes more decentralized, rate adjustments by central banks may have a delayed or muted effect.

3. The Long-Term Debt Cycle (75–100 Years): When Debt Becomes Unsustainable

The long-term debt cycle is the slow buildup of borrowing over decades. Eventually, debt levels grow so high that repayments consume more income than the economy can support. At this point, we reach a debt peak — and major deleveraging begins.

Dalio notes three major long-term debt peaks in U.S. history:

- 1929 (Great Depression)

- 1989 (Japanese asset bubble burst)

- 2008 (Global Financial Crisis)

The symptoms are the same: falling asset prices, declining income, mass defaults, and central banks intervening with aggressive monetary easing.

2025 Insight:

A July 2025 Reuters report warns that U.S. debt-to-GDP may surpass 145% by 2050, marking a risk for another long-term peak unless productivity outpaces borrowing. Current fiscal paths are deemed unsustainable by both the IMF and Congressional Budget Office.

Transactions: The Building Blocks of the Economy

Dalio simplifies everything into transactions — the exchange of money or credit for goods, services, or assets. Every transaction contributes to economic activity (GDP). Here’s the chain reaction:

- More credit = more spending

- More spending = higher income

- Higher income = more borrowing capacity

- More borrowing = even more spending

This cycle explains how booms form — and why busts follow.

Key point: Most money in the economy isn’t actual currency. It’s credit. According to the Federal Reserve’s Q1 2025 Flow of Funds Report, over 85% of all U.S. money supply exists as credit.

When credit contracts, total spending shrinks — and the economy slows down, even crashes.

Inflation, Deflation & Central Banks: How Policy Shapes Cycles

Central banks play a vital role in managing short- and long-term debt cycles. Their tools include:

- Raising/lowering interest rates

- Buying/selling government bonds (quantitative easing/tightening)

- Printing money in crisis scenarios

When inflation spikes (as seen in 2021–2023), central banks raise rates to slow spending. But as we saw in late 2023 and into 2024, this also risks deflation, job loss, and recessions.

2025 Insight:

A Financial Times editorial (May 2025) warned about “fiscal populism” — where central banks face pressure to monetize public debt. This undermines monetary independence and could reignite inflation if unchecked.

Dalio’s model explains this clearly: when rates hit zero, the only remaining tool is printing money. While this can boost asset prices, it must be carefully managed to avoid hyperinflation.

Deleveraging: The “Beautiful” vs. Ugly Way Out

When debt levels become too high to sustain, economies enter a phase called deleveraging. There are four main paths out of a debt crisis:

- Austerity: Spending cuts, lower wages → recession

- Debt defaults: Widespread bankruptcies → systemic risk

- Wealth redistribution: Taxing the rich → social unrest

- Money printing: Central bank stimulus → inflation risk

Dalio advocates for a balanced combination — what he calls “beautiful deleveraging” — where income rises faster than debt through controlled stimulus and long-term investment.

Case Study: The U.S. post-2008 recovery featured quantitative easing, tax policy shifts, and slow deleveraging. This is often cited as a textbook example of beautiful deleveraging — though inequality increased.

2025 Insight:

According to the IMF’s 2025 Global Fiscal Outlook, the best results occur when countries combine investment in green infrastructure (raising productivity) with progressive tax reform and controlled monetary easing.

Central Banks & Governments Must Coordinate — But Carefully

Dalio explains that central banks can create money, but not spend it. Governments can spend money, but not print it. That’s why coordination between fiscal and monetary policy is key during downturns.

In 2020–2022, governments borrowed at record levels while central banks bought their debt. This averted a depression, but also caused inflation in 2021–2023. The question for 2025 is: Can this be repeated safely?

“Too much money chasing too few goods is inflation. Too little money is depression.” — Ray Dalio

2025 Insight:

The Brookings Institution reported in March 2025 that emerging markets risk stagflation if central banks lose autonomy while supporting debt-laden governments.

The risk isn’t printing money — it’s printing too much, too quickly, without corresponding productivity growth.

People Also Ask

What is Ray Dalio’s economic machine?

It’s a framework that explains how transactions, productivity, and debt cycles interact to drive economic outcomes. Dalio’s model emphasizes simplicity, cause-and-effect logic, and historical repetition.

What are the short-term and long-term debt cycles?

- Short-term cycles occur every 5–8 years, triggered by changes in credit and interest rates.

- Long-term cycles occur every 75–100 years and culminate in widespread deleveraging and structural reform.

What is “beautiful deleveraging”?

It’s Dalio’s term for a balanced exit from debt crises — combining spending cuts, stimulus, and wealth transfers without causing inflation or depression.

Is the model still relevant in 2025?

Absolutely. Global debt is at historic highs, inflation and interest rates remain volatile, and central bank independence is under pressure. Dalio’s model offers a roadmap for navigating this uncertainty.

Conclusion: Simple, But Not Easy

Dalio’s brilliance lies in simplifying the economy without oversimplifying the truth. His economic machine reminds us that:

- Debt must not outgrow income

- Income must not outgrow productivity

- Balance is everything

“If you understand the economic machine, you can navigate it better.” – Ray Dalio

As the global economy approaches new fiscal frontiers in 2025, this timeless model is an invaluable tool — not just for economists, but for anyone who earns, saves, or invests.

References & Sources

- Ray Dalio – How the Economic Machine Works (YouTube)

- IMF Working Paper (July 2025) – “The Impact of Debt and Deficits on Long-Term Interest Rates”

- OECD Global Debt Outlook (2025)

- NBER Working Paper (April 2024) – “Short-Term Credit Volatility and Market Response”

- Financial Times (May 2025) – “Fiscal Populism vs Central Banks”

- Reuters (July 2025) – “US Fiscal Path May Trigger Long-Term Debt Crisis”