Digital Assets Are Redefining Value in the Global Economy

In today’s rapidly evolving financial landscape, digital assets have emerged as a transformative force, reshaping how we think about value, ownership, and investment. But what are digital assets exactly? At their core, digital assets are any items of value that exist in digital form, often leveraging blockchain technology to ensure security, transparency, and transferability. From cryptocurrencies like Bitcoin to non-fungible tokens (NFTs) and tokenized real-world assets, these innovations are not just buzzwords – they’re driving billions in economic activity worldwide.

As we enter 2026, the digital assets market is booming, with global adoption accelerating due to regulatory clarity and institutional involvement. According to a 2025 report from Security.org, approximately 28% of American adults now own cryptocurrencies, highlighting the mainstream shift. This guide will demystify digital assets, exploring their types, benefits, and practical applications, whether you’re a business owner eyeing cryptocurrency in business or an investor curious about digital assets examples.

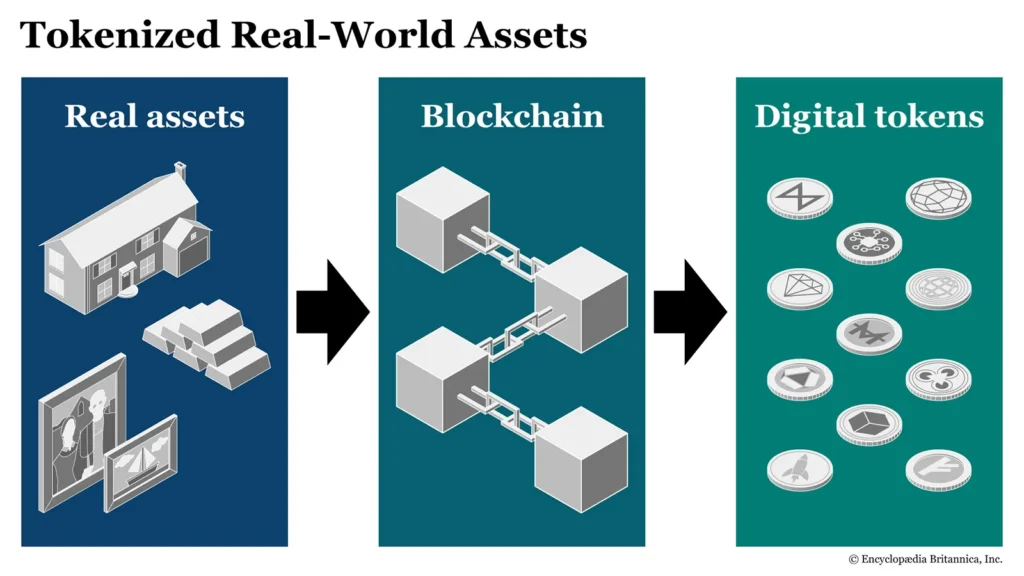

Imagine a world where traditional assets like real estate or stocks can be fractionalized and traded instantly across borders without intermediaries. That’s the promise of digital assets, and it’s already happening. Yet, many still wonder: what is a digital asset, and how can it fit into your strategy? Let’s dive deeper to build your interest and understanding.

What Is a Digital Asset? Definition, Context, and Evolution

What Is a Digital Asset?

A digital asset is fundamentally any digital file or representation that provides value and can be owned, transferred, or monetized. Traditional examples include photos, videos, documents, and software items managed through digital asset management (DAM) systems. However, the rise of blockchain has expanded this to include financial instruments like cryptocurrencies and tokens.

Key characteristics include:

- Discoverability: Easily searchable via metadata or blockchain explorers.

- Ownership: Proven through cryptographic keys or smart contracts.

- Value: Derived from utility, rarity, or market demand.

In the financial realm, digital assets are often minted on blockchains, as noted in PwC’s guide on understanding cryptocurrency and digital assets. This evolution addresses real-world problems like inefficient asset transfers and lack of transparency in traditional markets.

The Evolution of Digital Assets in the Blockchain Era

Blockchain technology has revolutionized digital assets by enabling decentralized, tamper-proof records. Early forms like Bitcoin (2009) focused on peer-to-peer payments, but today’s ecosystem includes sophisticated tokenized assets representing real-world items.

Statistics paint a vivid picture: The tokenized assets market is projected to grow significantly, with the World Economic Forum’s 2025 report on asset tokenization highlighting its potential to enhance value exchange in financial markets. Factors driving this include:

- Regulatory advancements, such as the U.S. GENIUS Act for stablecoins.

- Institutional adoption, with firms like BlackRock tokenizing funds.

- Global integration, reducing cross-border friction.

Yet, challenges persist, including volatility and regulatory gaps. The Financial Stability Board’s 2025 thematic review notes inconsistencies in global frameworks, urging better implementation.

What Are Digital Assets? Core Categories Explained

When people search for what are digital assets, they are typically referring to one or more of the following categories:

- Cryptocurrencies – decentralized digital money such as Bitcoin and Ethereum

- Stablecoins – cryptocurrencies pegged to fiat currencies

- Utility tokens – tokens providing access to products or services

- Governance tokens – tokens enabling voting rights within protocols

- NFTs (Non‑Fungible Tokens) – unique digital ownership certificates

- Tokenized assets – blockchain‑based representations of real‑world assets

Together, these categories form the foundation of the modern digital asset economy.

Cryptocurrency as a Foundational Digital Asset

Cryptocurrency Digital Assets: How They Work

Cryptocurrency digital assets are decentralized currencies secured through cryptography and maintained by distributed networks. Transactions are recorded on blockchains, eliminating the need for central authorities such as banks or payment processors.

Key characteristics include:

- Decentralization and censorship resistance

- Transparent, publicly verifiable ledgers

- Algorithmic or fixed supply mechanisms

- Peer‑to‑peer value transfer

Bitcoin functions primarily as a store of value and settlement asset, while Ethereum enables programmable finance through smart contracts.

Cryptocurrency in Business: From Experiment to Infrastructure

Cryptocurrency in business has evolved rapidly. What was once viewed as speculative is now used for real operational purposes:

- Cross‑border payments with lower fees

- Treasury diversification and inflation hedging

- On‑chain settlements for global commerce

- Fundraising through token issuance

Major corporations, fintech firms, and payment networks now integrate crypto rails, reducing friction in international transactions and enabling programmable financial logic.

Tokens, Smart Contracts, and Programmable Assets

Utility Tokens and Governance Tokens

Tokens extend digital assets beyond currency by embedding functionality directly into the asset itself.

- Utility tokens provide access to platforms, applications, or services

- Governance tokens grant holders voting rights over protocol upgrades and policies

These models enable decentralized ownership structures where users participate directly in decision‑making.

NFTs as Digital Assets Beyond Art

NFTs are often associated with digital art, but their economic significance goes far deeper. NFTs enable provable ownership of unique digital items and are increasingly used for:

- Intellectual property and licensing

- Gaming economies

- Digital identity systems

- Membership and loyalty programs

NFTs demonstrate that scarcity, ownership, and transferability can exist natively in digital environments.

Tokenized Assets and Institutional Adoption

What Are Tokenized Assets?

Tokenized assets are digital representations of real‑world assets recorded on a blockchain. These assets may include:

- Real estate and infrastructure

- Equities and bonds

- Commodities such as gold

- Private credit and funds

Tokenization allows assets to be fractionalized, traded globally, and settled instantly.

Why Financial Institutions Are Embracing Digital Assets

Banks and asset managers are adopting tokenization because it offers:

- Faster settlement and reduced counterparty risk

- Improved liquidity for traditionally illiquid assets

- Lower operational and compliance costs

- Continuous, 24/7 markets

For institutions, digital assets are not a replacement for traditional finance—but a technological upgrade to it.

Digital Asset Management, Security, and Compliance

Digital Asset Management Explained

Digital asset management refers to the systems, policies, and technologies used to store, secure, track, and govern digital assets.

Effective digital asset management includes:

- Secure custody and key management

- Portfolio and exposure tracking

- Risk controls and access permissions

- Regulatory reporting

Digital Asset Management Software

Digital asset management software enables enterprises and institutions to manage crypto and tokenized assets safely. Core features typically include:

- Institutional‑grade custody solutions

- Multi‑signature authorization

- Audit trails and reporting

- Integration with compliance systems

Digital Assets Transaction Monitoring

As adoption grows, digital assets transaction monitoring has become essential. Monitoring tools help:

- Detect suspicious activity

- Prevent money laundering and fraud

- Ensure compliance with global regulations

- Build trust with regulators and partners

This compliance layer is critical for mainstream adoption.

Why Digital Assets Matter for the Future

Strategic Advantages of Digital Assets

Digital assets offer structural advantages over traditional systems:

- Speed: Near‑instant settlement

- Transparency: Public verification

- Programmability: Automated logic via smart contracts

- Accessibility: Global participation

These features unlock new business models, investment opportunities, and financial efficiencies.

Digital Assets Examples Across Industries

- Finance: Stablecoins, tokenized bonds

- Business: On‑chain payments, crypto treasuries

- Real Estate: Fractional ownership

- Media: NFTs and digital rights

- Supply Chain: Tokenized tracking systems

People Also Ask: Digital Assets FAQ

What is a digital asset in simple terms?

A digital asset is anything valuable that exists digitally and can be owned or transferred electronically.

Are cryptocurrencies digital assets?

Yes. Cryptocurrencies are one of the most common types of digital assets.

How are digital assets used in business?

Businesses use digital assets for payments, investments, fundraising, and operational efficiency.

Is Bitcoin a digital asset or a currency?

Bitcoin is both a digital asset and a decentralized digital currency.

What is digital asset management?

Digital asset management involves securing, tracking, and governing digital assets using specialized tools.

Understanding Tokenization

Recommended Video: “Tokenization Explained: The Future of Finance” (YouTube, 2024)

This video complements the article by explaining how financial institutions are adopting digital assets and tokenization in real‑world markets.

Expert Takeaways and Next Steps

Digital assets represent a structural shift in how value is created, transferred, and stored.

Expert insight:

“Digital assets are not a trend – they are financial infrastructure in the making.”

Actionable Next Steps

- Educate yourself on crypto and tokenized assets

- Assess digital asset exposure in portfolios or businesses

- Explore compliant digital asset management solutions

- Stay informed on regulation and institutional adoption

Understanding digital assets today is a strategic advantage for tomorrow.

Take Action with Digital Assets Today

Digital assets offer unparalleled opportunities for innovation, efficiency, and growth. From understanding what digital assets are to implementing them in your strategy, the benefits of faster transactions, global access, and new revenue streams far outweigh the risks when managed wisely.

As an expert, I advise starting small: Educate yourself, diversify investments, and use reputable platforms. For businesses, integrate cryptocurrency digital solutions to stay competitive.

Actionable takeaway: Assess your portfolio today consider tokenizing assets or adopting DAM software. Consult a financial advisor to navigate regulations.

“Embrace digital assets now to lead in tomorrow’s economy,” echoes the White House’s 2025 report.