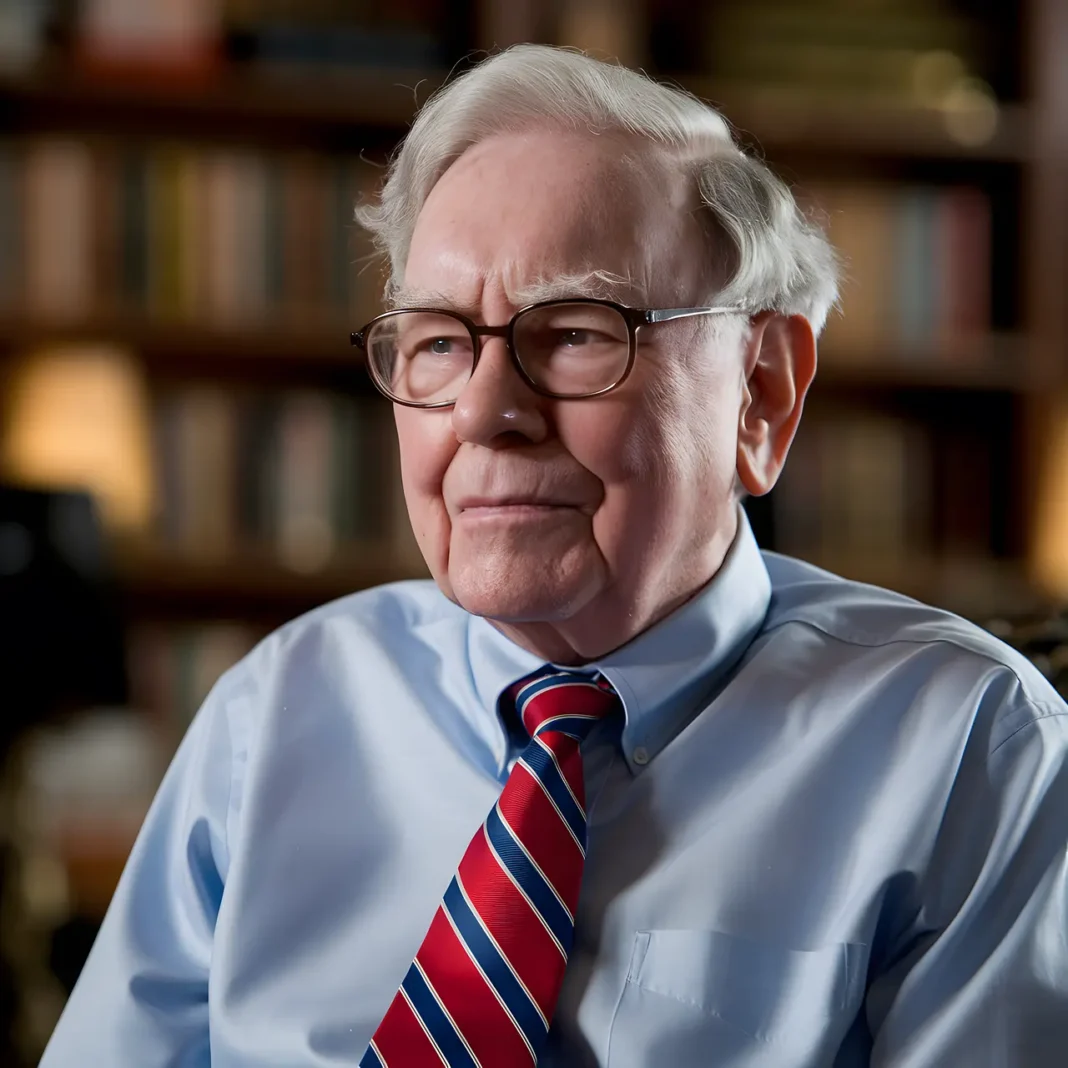

Warren Buffett, one of the greatest investors of all time, shares timeless wisdom that has shaped his incredible success. These lessons go beyond finance – they’re principles for life and investing alike. Here are the three key lessons Buffett reveals that transformed his approach to investing and wealth-building.

1. Never Lose Money – The Golden Rule of Investing

Buffett’s first and second investing rules are simple but profound:

- Rule Number One: Never lose money.

- Rule Number Two: Never forget rule number one.

Investing isn’t about being a financial genius; it’s about avoiding costly mistakes. Losses hurt more than gains feel good. Protecting your capital is paramount because losses compound negatively, setting you back significantly.

2. Patience and Discipline Are Your Greatest Assets

The market provides opportunities – if you’re willing to wait long enough. Buffett likens investing to farming: harvests don’t come instantly, and the roots must grow silently and steadily beneath the surface.

Key traits investors must develop:

- Patience: Wealth builds slowly over time, often quietly and invisibly.

- Discipline: Stick to your principles, avoid chasing quick wins or following the crowd.

- Emotional Control: Resist panic during market downturns. Emotional strength is more valuable than brilliance.

Buffett emphasizes that impatience often costs more than it seems. Instead, owning valuable assets and waiting calmly for them to appreciate is the true essence of investing success.

3. Invest in What You Understand – Minimize Risk by Staying in Your Circle of Competence

You don’t need to know everything to succeed in investing, but you must operate within your competence. Investing in businesses or sectors you understand greatly reduces risk and stress.

Buffett warns against becoming vulnerable by owning investments you don’t comprehend, especially when prices fall and panic sets in. The smartest strategy is to focus on areas where your knowledge gives you confidence and patience.

Additional Insights from Buffett’s Investing Journey

- Long-Term Thinking: The market rewards patient investors, not those chasing quick profits. Wealth comes from steady accumulation and reinvesting earnings over years.

- Price vs. Value: Stock price doesn’t always reflect true value. Real gains arise from owning quality businesses, not short-term market movements.

- Consistency Over Speed: True success stems from consistent, disciplined investing, not gambling or frantic speculation.

- Emotional Strength Beats IQ: Self-control and composure in volatile markets are more important than intelligence.

- Invest in Yourself: Buffett considers the best investment to be in yourself – enhancing character, knowledge, and patience.

Practical Example: Staying Calm During Crisis

Buffett’s Berkshire Hathaway famously increased investments during the 2008 financial crisis when others panicked. Fear creates opportunities, but only those who remain calm and patient can seize them.

The Universal Truth of Investing and Life

Buffett’s investing lessons double as life lessons:

- Character beats IQ.

- Long-term perspective trumps short-term impulses.

- Value creation surpasses chasing prices.

- Patience overcomes panic.

- Discipline and humility build lasting wealth.

Summary: The Timeless Three Lessons to Master

- Never lose money.

- Be patient and disciplined.

- Stay within your circle of competence.

By internalizing these principles, ordinary people can achieve extraordinary results by controlling emotions, following a consistent plan, and focusing on worth and value.

Final Thought: Your Best Investment Is You

Ultimately, Warren Buffett teaches us that the greatest investment you can make is in your own self – your character, patience, discipline, and ability to stay calm under pressure. These qualities reflect in your investing success and in your life.

If you want to build lasting wealth and thrive in investing and life, follow Buffett’s simple but powerful blueprint:

Patience. Discipline. Value. Time.

Success follows those who respect these timeless truths.