Skyrocketing Rents Around the Globe

The global rental market has seen unprecedented growth in 2025. The most expensive rent in 2025 continues to surge in major financial and cultural hubs, with record-high costs in cities like New York, Singapore, and London. Across the top 20 cities worldwide, a one-bedroom apartment in the city center now commands thousands of dollars per month, reshaping the urban living landscape.

Factors such as limited housing supply, economic growth, and a rising wave of remote workers moving to high-demand cities are driving rents higher than ever. Understanding these dynamics is essential for renters, investors, and policymakers alike.

The Global Leaders in Rental Costs

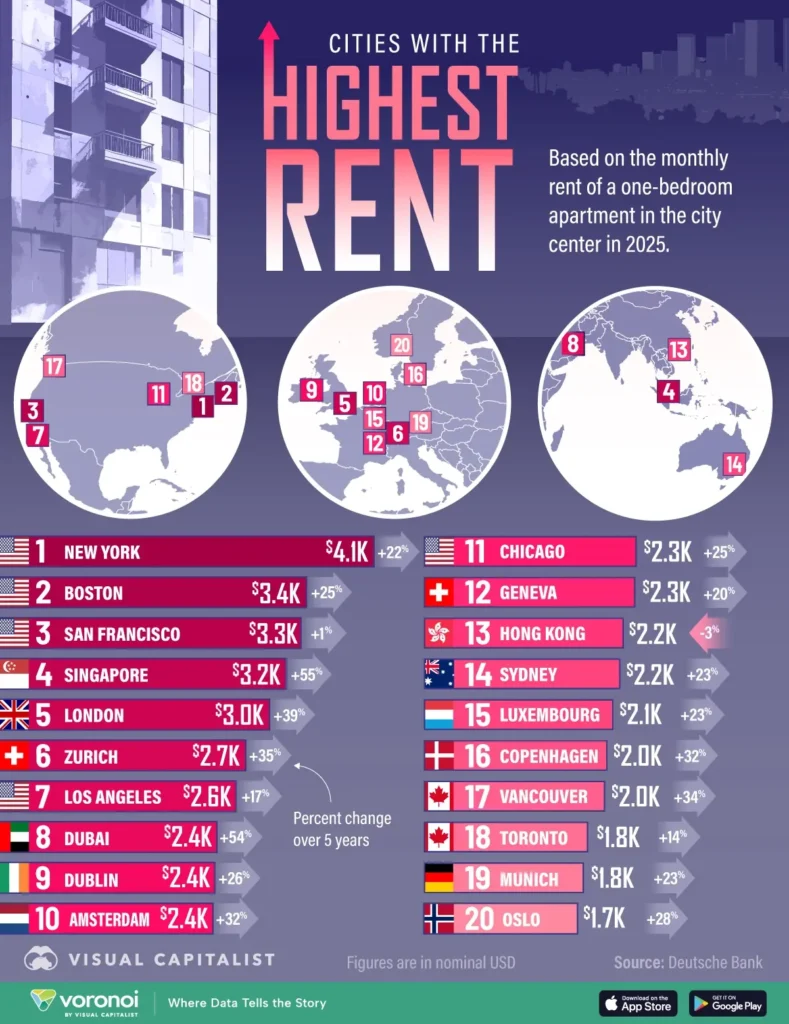

Here’s the latest ranking of cities with the most expensive rent in 2025, based on Deutsche Bank data (one-bedroom apartment, city center):

| Rank | City | Country | Monthly Rent (USD) | 5-Year Cumulative Change |

|---|---|---|---|---|

| 1 | New York | USA | $4,143 | 22% |

| 2 | Boston | USA | $3,394 | 25% |

| 3 | San Francisco | USA | $3,332 | 1% |

| 4 | Singapore | Singapore | $3,167 | 55% |

| 5 | London | UK | $2,985 | 39% |

| 6 | Zurich | Switzerland | $2,720 | 35% |

| 7 | Los Angeles | USA | $2,613 | 17% |

| 8 | Dubai | UAE | $2,401 | 54% |

| 9 | Dublin | Ireland | $2,378 | 26% |

| 10 | Amsterdam | Netherlands | $2,358 | 32% |

| 11 | Chicago | USA | $2,344 | 25% |

| 12 | Geneva | Switzerland | $2,330 | 20% |

| 13 | Hong Kong | Hong Kong | $2,202 | -3% |

| 14 | Sydney | Australia | $2,164 | 23% |

| 15 | Luxembourg | Luxembourg | $2,086 | 23% |

| 16 | Copenhagen | Denmark | $2,021 | 32% |

| 17 | Vancouver | Canada | $1,994 | 34% |

| 18 | Toronto | Canada | $1,807 | 14% |

| 19 | Munich | Germany | $1,759 | 23% |

| 20 | Oslo | Norway | $1,689 | 28% |

Key Insights:

- New York tops the list at $4,143/month.

- Singapore leads Asia with $3,167/month, highlighting its role as a financial hub.

- Dubai shows a remarkable 54% increase over five years.

- European cities such as London, Zurich, and Amsterdam have seen dramatic rent surges, sparking protests over housing affordability.

What’s Driving These High Rents?

Several key factors contribute to soaring rent prices worldwide:

- Limited Housing Supply: Cities like New York, London, and Zurich face strict zoning laws and constrained land availability, reducing housing stock.

- High Demand: Economic opportunities and global talent influx elevate demand in financial centers like Singapore and Dubai.

- Remote Work Trends: Post-pandemic migration patterns have shifted renters toward high-quality urban locations, boosting prices.

- Foreign Investment: International property buyers and commercial investors push up real estate values, impacting rental markets.

- Inflation and Cost of Living: Rising construction costs and general inflation force landlords to increase rent.

Regional Highlights and Market Opportunities

North America

- New York, Boston, San Francisco, Los Angeles, Chicago dominate with the highest U.S. rental prices.

- Boston has surged 25% over five years, reflecting high demand for educational and tech hubs.

Europe

- London, Zurich, Dublin, Amsterdam, Geneva, Copenhagen, Munich, Oslo

- London leads Europe at nearly $3,000/month, with a 39% rise in five years.

- Zurich and Geneva reflect Switzerland’s high living standards and limited housing supply.

Asia-Pacific & Middle East

- Singapore, Dubai, Sydney, Hong Kong

- Singapore and Dubai have seen the steepest 5-year rent increases (55% and 54% respectively).

- Hong Kong experienced a slight decline (-3%), reflecting a cooling housing market.

Canada

- Vancouver and Toronto remain expensive, with Vancouver at nearly $2,000/month, driven by foreign investment and housing scarcity.

Commercial Real Estate: The Other Side of High Rent

High residential rents are mirrored in commercial real estate:

- Prime office space in New York, London, and Hong Kong can exceed $100 per square foot annually.

- Cities with strong business ecosystems attract multinational tenants, pushing commercial rents higher.

- Investors seeking prime retail and office spaces must navigate highly competitive markets.

How Renters Can Navigate High-Cost Cities

- Explore Suburbs and Commuter Towns: Often more affordable while offering access to city jobs.

- Consider Co-Living or Shared Housing: Reduces individual costs significantly.

- Leverage Technology: Apps and real-time market data help identify deals.

- Negotiate Lease Terms: Some landlords offer concessions for longer commitments.

- Invest Wisely: For investors, focus on cities with growing demand and limited supply for long-term returns.

“Understanding rental dynamics in the world’s top cities requires a combination of market knowledge, economic trends, and demographic insight. Tenants and investors alike benefit from proactive research and planning.” – Dorothy Neufeld, Visual Capitalist

People Also Asked (FAQ)

What is the most expensive city in the world in 2025?

New York City remains the most expensive city, with average rent for a one-bedroom apartment at $4,143/month.

Which state has the cheapest rent in 2025?

States like Arkansas, West Virginia, and Mississippi offer significantly lower rental costs than urban hubs.

What cities have the highest rent prices?

New York, Boston, San Francisco, Singapore, London, Zurich, Los Angeles, Dubai, Dublin, Amsterdam top the global rental market in 2025.

What is the top 10 most expensive city to live in the world?

New York, Boston, San Francisco, Singapore, London, Zurich, Los Angeles, Dubai, Dublin, Amsterdam.

What is the most expensive commercial rent in the world?

New York, London, Hong Kong lead the commercial rental market, with prime office spaces exceeding $100 per sq. ft. annually.