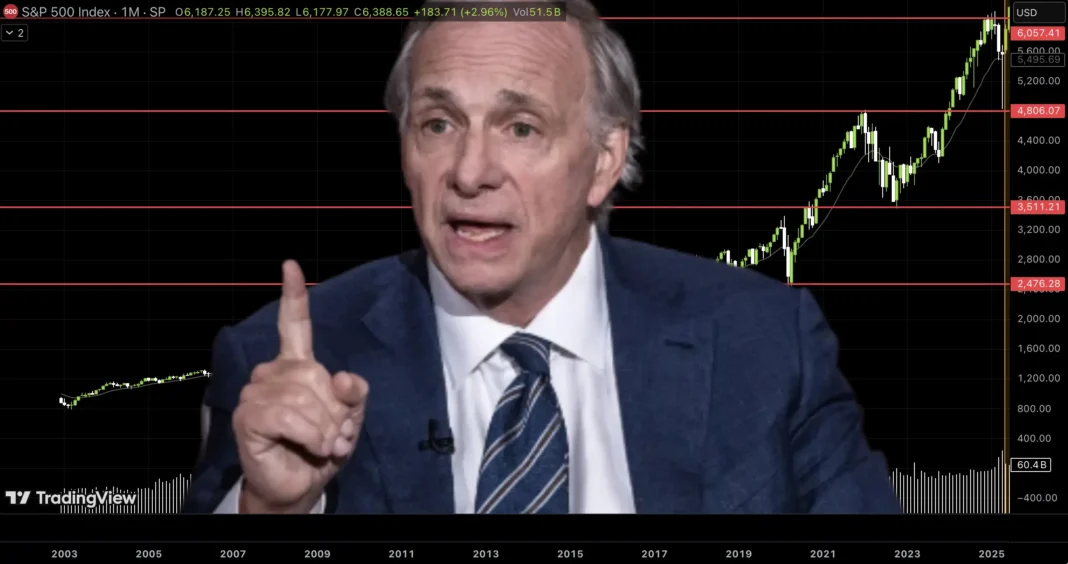

Ray Dalio’s Ray Dalio forecast for 2025 is a critical alert for investors, predicting a debt-driven crisis that could eclipse a typical recession. As the founder of Bridgewater Associates, Dalio’s accurate predictions of the 2008 financial crisis and post-COVID inflation lend weight to his Ray Dalio 2025 prediction. In his YouTube video, “Ray Dalio: What’s Coming Is Much WORSE Than A Recession” (YouTube), he warns of risks from unsustainable debt, currency devaluation, and geopolitical tensions. This article unpacks the Ray Dalio forecast, offering actionable strategies for financiers, traders, and small business owners to navigate the turbulent future of the economy.

This article dives into Dalio’s Ray Dalio 2025 prediction, unpacking its key components, implications for investors, and practical strategies to safeguard wealth. Whether you’re a financier, trader, investor, or small business owner, understanding the Ray Dalio inflation and recession warning can help you prepare for the future of the economy. With global debt exceeding $300 trillion and rising geopolitical risks, now is the time to act strategically.

The Big Debt Cycle: A Historical Perspective

At the heart of Dalio’s Ray Dalio economic forecast is the concept of the “big debt cycle,” a rare economic phenomenon occurring roughly every 75–100 years. Unlike typical business cycles that cause short-term recessions, big debt cycles involve systemic issues stemming from excessive debt accumulation. Dalio draws on historical events to illustrate the gravity of the situation:

- 1930s Great Depression: Excessive debt led to asset price collapses, prompting governments to devalue currencies to stabilize markets. This provided temporary relief but set the stage for long-term challenges.

- 1970s Stagflation: The 1971 decision by President Nixon to end the gold standard triggered currency devaluation, high inflation, and stagnant growth. Central banks’ money printing fueled asset price increases but worsened debt issues.

- 2008 Financial Crisis: Dalio’s foresight in predicting this crisis stemmed from his analysis of debt and interest rate dynamics, which he sees reemerging today.

As of July 2025, global debt stands at over $300 trillion, or 322% of global GDP (LiveMint). The U.S. alone faces a $36 trillion debt burden, with an annual interest bill exceeding $1 trillion (Fortune). Dalio warns that this could lead to a Ray Dalio market crash warning, potentially triggering a “debt death spiral” if not addressed.

Why Worse Than a Recession?

A typical recession involves a temporary economic slowdown followed by recovery. In contrast, Dalio’s Ray Dalio inflation and recession forecast points to a deeper, structural crisis with three key drivers:

- Debt Overload: When debt outpaces income, servicing it becomes unsustainable, leading to defaults and economic contraction. The U.S. must roll over $9 trillion in debt, a challenge if creditors lose confidence.

- Currency Devaluation: Central banks printing money to manage debt devalues currencies, driving inflation and eroding purchasing power.

- Geopolitical Risks: Tensions, particularly between the U.S. and China, could disrupt bond markets, amplifying the crisis. Dalio draws parallels to the 1930s, when geopolitical conflicts froze markets.

Dalio compares excessive debt to “plaque in the arteries” of the economy, restricting financial circulation and risking an “economic heart attack” if the fiscal deficit, currently at 7.5% of GDP, isn’t reduced to 3% within three years.

Key Components of Dalio’s 2025 Forecast

Dalio’s Ray Dalio 2025 prediction outlines several interconnected trends shaping the future of the economy. Here are the critical elements, drawn from his video and supporting sources:

1. Inflection Point and Debt Crisis

The global economy is at an “inflection point,” where debt levels are reaching a breaking point. Key indicators include:

- The U.S. government’s $1 trillion annual interest bill, diverting funds from productive spending.

- The need to refinance over $9 trillion in debt, which could become problematic if bond buyers, like central banks or foreign investors, hesitate.

- Rising interest rates and widening credit spreads, signaling potential defaults (CNBC).

2. Monetary and Fiscal Responses

To address a debt crisis, central banks like the Federal Reserve are likely to:

- Print Money: Engage in quantitative easing (QE) by purchasing government bonds to stabilize markets, as seen in 2008 and 2020.

- Devalue Currencies: This increases inflation, reducing the real value of debt but eroding savings.

Dalio warns that these measures could lead to a global currency crisis, similar to the 1970s, where all major currencies depreciate together.

3. Currency Depreciation

Unlike typical currency fluctuations, Dalio predicts a simultaneous depreciation of major currencies (USD, EUR, JPY, CNY). This global devaluation will push investors toward alternative stores of wealth, such as gold and Bitcoin.

4. Alternative Assets as Safe Havens

To hedge against currency depreciation and inflation, Dalio recommends:

- Gold: A time-tested store of value, currently the third-largest reserve asset globally, after the dollar and euro.

- Bitcoin: With its limited supply, Bitcoin could serve as a digital hedge against fiat currency devaluation.

- Diversification: Holding a small percentage (around 15%) of gold in portfolios for protection during crises.

5. Geopolitical Risks

Geopolitical tensions, particularly between the U.S. and China, could exacerbate the crisis. Dalio highlights:

- Concerns about countries like China holding large U.S. debt reserves, which could be disrupted by sanctions, as seen in the 1930s with Japan.

- The risk of a bond market crisis if foreign investors reduce purchases due to geopolitical or economic concerns (World Economic Forum).

6. Policy Recommendations

Dalio advocates for a “beautiful deleveraging,” balancing:

- Fiscal Tightening: Raising taxes or cutting spending to reduce deficits.

- Monetary Stimulus: Easing monetary policy to support growth.

However, he acknowledges that such policies are politically challenging, often leading to short-term economic pain.

7. Warning Signs

Recent events serve as precursors to a larger crisis:

- The U.S. government’s COVID-19 spending, which doubled income losses in 2020–2021, created inflationary pressures.

- Rising interest rates and inflation are early indicators of a potential bond market crisis, as seen in 2020–2021.

Implications for Investors

Dalio’s Ray Dalio economic forecast has profound implications for investors, particularly in structuring resilient portfolios. Traditional strategies, such as a 60/40 stock-bond portfolio, may not withstand the volatility of a debt-driven crisis. Here’s how investors can prepare:

Diversification Strategies

To navigate the future of the economy, Dalio recommends:

- Real Assets: Real estate, infrastructure, and agricultural land offer intrinsic value and act as inflation hedges (DailyPumpDump).

- Commodities: Gold, silver, and oil can benefit from currency depreciation and supply constraints.

- Emerging Markets: Projected to grow faster than developed economies (IMF, 2024), these markets offer diversification benefits.

- Private Markets: Startups and venture capital provide exposure to innovation, though they are less liquid.

- Cryptocurrencies: Bitcoin and other digital assets can hedge against fiat currency devaluation due to their limited supply.

Practical Tips for Investors

- Maintain Cash Reserves: Keep liquidity to capitalize on market dips during volatility.

- Avoid Overexposure to Bonds: Government bonds may lose value as interest rates rise.

- Monitor Economic Indicators: Track interest rates, inflation, and bond yields for signs of escalation.

- Consult a Financial Advisor: Tailor strategies to your risk tolerance and financial goals.

Learning from Economic Cycles

Dalio’s books, such as Principles for Navigating Big Debt Crises and Principles for Dealing with the Changing World Order (Amazon), provide frameworks for understanding economic cycles. Investors can use these insights to anticipate market shifts and adjust their portfolios accordingly.

Addressing Skepticism

While Dalio’s track record lends credibility, some experts question the timing and severity of his predictions. For instance:

- A Wealth of Common Sense (A Wealth of Common Sense) suggests Dalio’s repeated warnings about debt crises have yet to fully materialize, comparing him to “the boy who cried wolf.”

- His prediction of a U.S.-China economic decoupling has been debated as premature by some analysts.

Broader 2025 forecasts provide context:

- The IMF projects 3.3% global growth, acknowledging debt risks but remaining optimistic (IMF).

- Deloitte anticipates a U.S. economic slowdown due to high interest rates and debt (Deloitte).

- The World Bank forecasts 2.3% global growth, citing trade and debt challenges (World Bank).

These perspectives suggest a balanced approach: heed Dalio’s Ray Dalio market crash warning but consider multiple viewpoints when planning.

Key Investment Strategies for 2025

| Asset Class | Why Invest? | Risk Level | Example |

|---|---|---|---|

| Real Assets | Intrinsic value, inflation hedge, stable cash flow | Low-Moderate | Real estate, farmland |

| Commodities | Protection against currency depreciation, geopolitical leverage | Moderate | Gold, silver, oil |

| Emerging Markets | Faster growth, technological innovation, currency diversification | Moderate-High | Southeast Asia, Africa ETFs |

| Private Markets | Exposure to innovation, lower correlation with public markets | High | Venture capital, startups |

| Cryptocurrencies | Hedge against fiat currency devaluation, limited supply | High | Bitcoin, Ethereum |

Conclusion

Ray Dalio’s Ray Dalio 2025 prediction serves as a critical warning of a potential crisis worse than a recession, driven by unsustainable debt, currency depreciation, and geopolitical risks. His Ray Dalio inflation and recession insights highlight the need for proactive financial planning. By diversifying portfolios with real assets, commodities, emerging markets, and alternative assets like gold and Bitcoin, investors can mitigate risks and position for growth.

As we approach 2025, staying informed and adaptable is essential. Dalio’s analysis, grounded in historical cycles, offers a roadmap for navigating the future of the economy. Investors should consult financial advisors to tailor these strategies to their unique goals and risk tolerance, ensuring resilience in turbulent times.

Citations

- FREENVESTING YouTube Channel

- World Economic Forum

- CNBC

- LiveMint

- A Wealth of Common Sense

- Fortune

- IMF

- Deloitte

- World Bank

Posts of interest:

5 Best Assets to Invest in 2025 to Build Long-Term Wealth

How The Economic Machine Works by Ray Dalio: 2025 Breakdown of Debt, Productivity & Inflation

Howard Marks Investing Wisdom: Timeless Insights for 2025