By late 2025, the financial world crossed a definitive rubicon. The question shifted from “Will crypto survive?” to “How quickly can we integrate distributed ledgers?” With how blockchain works in finance now a central pillar of strategy for giants like J.P. Morgan and BlackRock, the technology has graduated from speculative asset classes to the operational backbone of global markets.

In this guide, we strip away the hype to explain the technical and operational mechanics of blockchain in the modern financial stack. We will move beyond basic definitions to explore how Distributed Ledger Technology (DLT), smart contracts, and tokenization are orchestrating a shift from probability-based reconciliation to deterministic, trustless settlement.

1. The Mechanics of Trustless Transactions

To understand how blockchain works in finance, one must first abandon the mental model of the “central master ledger” used by traditional banks. In a centralized system, Bank A and Bank B each maintain private ledgers. When money moves between them, they must reconcile these disparate records-a process prone to error and delay.

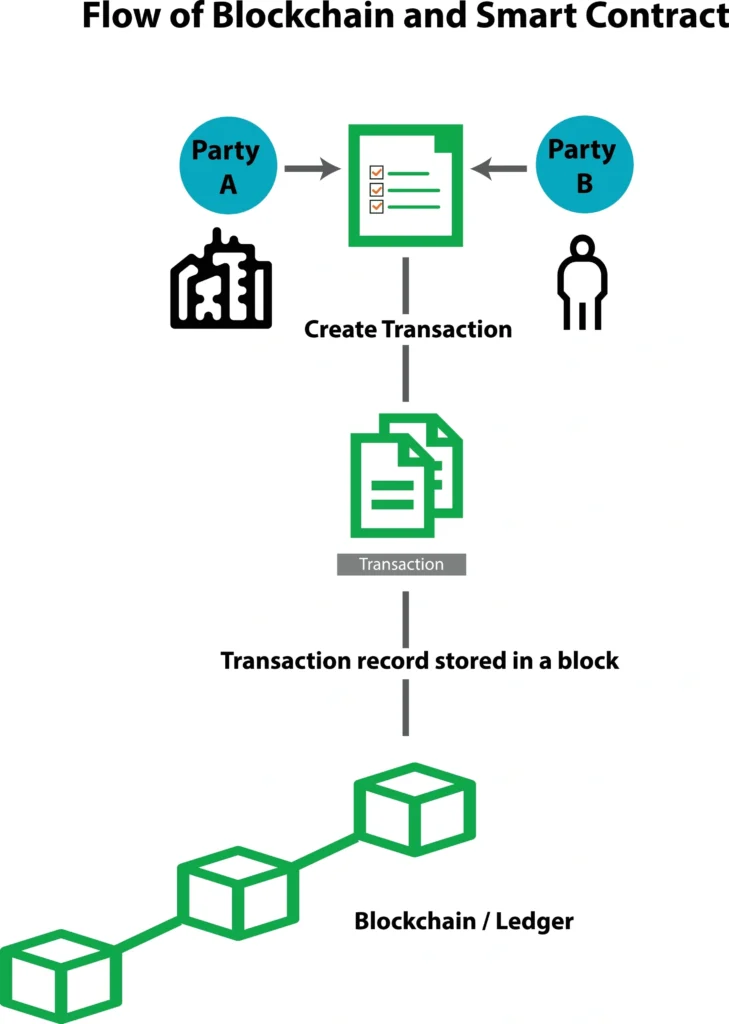

Blockchain replaces this with a Distributed Ledger Technology (DLT).1 Here is the technical breakdown of a financial transaction on a blockchain:

- Initiation & Signing: A user (or automated system) initiates a transaction. This request is cryptographically signed using a private key, proving mathematical ownership of the assets without revealing identity.

- Broadcasting: The transaction is broadcast to a peer-to-peer (P2P) network of nodes (computers).

- Validation (Consensus): Unlike a bank manager approving a transfer, the network uses a consensus mechanism.2 In the modern, energy-efficient financial era of 2025-2026, this is predominantly Proof of Stake (PoS). Validators stake capital to attest that the transaction is valid (i.e., the sender has the funds and hasn’t spent them twice).

- Hashing & Chaining: Validated transactions are grouped into a “block.” This block is assigned a unique cryptographic hash (a digital fingerprint).3 Crucially, it also contains the hash of the previous block. This chaining creates an immutable history; altering a transaction from 2024 would require recalculating the hash for every subsequent block-a computational impossibility.

- Finality: Once added to the chain, the ledger is updated across all nodes simultaneously. Settlement is not “requested”; it is final.

2. DLT vs. Traditional Banking: The Settlement Revolution

The most profound impact of how blockchain works in finance lies in the difference between messaging and settlement.

In the traditional correspondent banking model (pre-2025 SWIFT integration), sending money cross-border involved a series of messages. Bank A sends a SWIFT message to Bank B. Bank B updates its ledger. If the banks don’t have a direct relationship, they use intermediaries. Actual settlement (the movement of value) might take T+2 days.

Blockchain collapses messaging and settlement into a single atomic action.

Comparative Analysis: Cross-Border Payment

| Feature | Traditional Correspondent Banking | Blockchain-Based Settlement (2026) |

| Architecture | Siloed ledgers + Messaging (SWIFT MT) | Shared Ledger + Smart Contracts |

| Speed | 1-3 Days (T+2) | Near-Instant (Seconds/Minutes) |

| transparency | Opaque (Black Box) | Transparent & Traceable |

| Cost | High (Intermediary fees, FX spreads) | Low (Gas fees, direct P2P) |

| Risk | Counterparty Credit Risk | Atomic Swap (Delivery vs. Payment) |

2026 Context: By November 2025, SWIFT successfully integrated blockchain-based settlement capabilities, allowing banks to settle tokenized assets using ISO 20022 standards. This hybrid model bridges the gap, allowing legacy banks to interact with DLT without ripping out existing infrastructure.

3. Smart Contracts: Automating Compliance and Yield

If the ledger is the database, smart contracts are the business logic. A smart contract is self-executing code stored on the blockchain that automatically runs when predetermined conditions are met.4

In finance, this replaces manual back-office operations with “programmable money.”

The “If-This-Then-That” of Finance

Consider a Tokenized Money Market Fund, a trend that exploded in late 2025 with J.P. Morgan’s Ethereum-based offerings.5

- Traditional Process: An investor buys shares. A broker records the trade. A transfer agent updates the registry. Dividends are calculated manually and distributed monthly.

- Blockchain Process: The investor sends stablecoins to the smart contract. The contract automatically mints fund tokens to the investor’s wallet. Yield is accrued by the second and paid out automatically via code.

Embedded Compliance

Smart contracts also enforce regulation.6 For instance, an ERC-3643 token standard can enforce identity verification. If a wallet address hasn’t passed KYC (Know Your Customer) checks, the smart contract will mathematically reject the transfer. This is “compliance by design,” preventing illicit flows before they happen.

4. Real-World Use Cases: Tokenization & The “Institutional Era”

As we move through 2026, the theoretical phase is over. Here is how blockchain works in finance in live production environments.

Tokenization of Real-World Assets (RWA)

Tokenization involves creating a digital twin of a physical or traditional financial asset on a blockchain.7

- The Data: According to RWA.xyz, the total value of real-world assets on public blockchains exceeded $18.5 billion by the end of 2025.8

- The Mechanism: Institutions like BlackRock and Franklin Templeton now issue treasury funds directly on-chain. Investors hold tokens representing shares.9 These tokens can be used as collateral in DeFi (Decentralized Finance) applications 24/7, unlocking liquidity from previously illiquid assets.10

Repo Markets and Intraday Liquidity

Banks typically hold billions in “buffer capital” because they can’t move cash instantly at night or on weekends. Blockchain solves this with intraday repo (repurchase agreements).

- Case Study: J.P. Morgan’s Onyx platform allows banks to tokenize collateral (like U.S. Treasuries) and swap it for digital cash instantly. This frees up billions in trapped capital, optimizing balance sheets with precision previously impossible.

Commercial Paper on Public Chains

In December 2025, a landmark shift occurred when commercial paper was issued and settled on the Solana blockchain.11 This demonstrated that high-throughput public blockchains (processing 65,000+ transactions per second) are now robust enough for institutional debt markets, offering transparency and speed that private bank chains cannot match.

People Also Asked

How is blockchain used in financial services?

Blockchain is used for payments (instant cross-border settlement), tokenization (digitizing stocks, bonds, and real estate), trade finance (automating letters of credit), and compliance (immutable audit trails).12 In 2026, it is primarily an infrastructure layer that makes assets programmable and liquid 24/7.

What are the benefits of blockchain in finance?

The primary benefits are Trustless Settlement (removing intermediaries), Speed (T+0 settlement vs T+2), Transparency (shared source of truth), and Cost Reduction (automation of back-office reconciliation).13 It essentially upgrades the “operating system” of money.

Is blockchain in finance safe?

Yes, but the risk profile changes. While the cryptography (math) is nearly unbreakable, risks shift to Smart Contract vulnerabilities (bugs in the code) and Key Management (losing access to digital wallets). However, with 2025’s introduction of institutional-grade custody solutions and regulated “permissioned” pools, it is now considered safer than many legacy systems.

What is the future of blockchain in finance?

The future is Interoperability. We are moving toward a “Unified Ledger” concept where central bank digital currencies (CBDCs), tokenized deposits, and stablecoins coexist on interconnected networks. SWIFT’s 2025 integration of DLT proves the future is a hybrid of traditional banking standards and blockchain rails.14

Conclusion

Understanding how blockchain works in finance is no longer about understanding cryptocurrency speculation; it is about understanding the new architecture of value transfer. We have moved from the “Wild West” of isolated experiments to the “Industrial Age” of digital finance.

The shift is from reconciling ledgers to sharing them. By 2026, the integration of platforms like SWIFT with public chains like Ethereum and Solana signals that the technology has matured. It is invisible, efficient, and foundational.

“The results of 2025 suggest that tokenization should be viewed not as a temporary technological trend but as a long-term driver of financial market transformation.15 The core infrastructure is now largely in place.” – 2026 Market Outlook, Financial Tech Analysis16